What is The Carbon Border Adjustment Mechanism(CBAM)?

Climate change is a problem that requires solutions on a global scale. With the EU increasing its climate ambition, there is a risk of ‘carbon leakage’ as long as less strict climate policies are present in many non-EU countries. Carbon leakage can occur when companies in the EU move carbon-intensive production to countries with less stringent climate policies or when more carbon-intensive imports replace EU products.

In order to prevent the risk of carbon leakage, the European Commission has introduced Carbon Border Adjustment Mechanism (CBAM) and entered into force on 16 May 2023.

How does CBAM work?

The Carbon Border Adjustment Mechanism (CBAM) aims to impose a fair price on the carbon emitted during the production of carbon-intensive goods imported into the EU, while also incentivizing cleaner industrial production in non-EU countries. The CBAM will be gradually introduced in coordination with the phase-out of free allowances under the EU Emissions Trading System [ETS] to support the decarbonization of EU industry. The CBAM will confirm that carbon emissions generated in the production of certain goods imported into the EU have been paid for, ensuring that the carbon price of imports is equivalent to that of domestic production and that the EU’s climate goals are not compromised.

Why should you pay attention to CBAM?

If you are planning to export your product to European Union countries, it is important to ensure that your product meets the necessary requirements and regulations. Failing to comply with these regulations can result in additional costs which could potentially harm your margins and reduce the competitiveness of your product in the EU market. Therefore, it is highly recommended to thoroughly research and understand the regulations in the EU countries where you plan to export your product. This will help you avoid any unnecessary costs or delays in the export process and improve your chances of success in the EU market.

How should I start complying with CBAM?

To begin implementing CBAM, it is important to first understand the key concepts and principles that underlie this approach. One important consideration is to establish a clear understanding of the current state of your organization and the specific challenges and opportunities that need to be addressed through the implementation of CBAM.

(1) Measure Your Existing Carbon Footprints

To measure your current carbon footprint, you can use online calculators or professional services to measure your carbon footprint – TT GREEN covers more than 400 regions and 500 emission activities globally complies with international frameworks to assist corporates in calculating their carbon footprints.

(2) Set Reduction Targets (short-term and long-term)

Once you know your carbon footprint, you can set reduction targets. Reduction targets can be short-term or long-term and should be specific, measurable, achievable, relevant, and time-bound (SMART). For example, you could set a target to reduce your carbon emissions by 20% in the next 5 years. It’s important to regularly monitor your progress towards these targets. Tools like TT GREEN can help you track your carbon emissions in real-time and monitor progress towards your targets.

(3) Implement a Carbon Reduction Plan

To achieve your reduction targets, you need to implement a carbon reduction plan. A reduction plan should include a range of measures such as:

- Energy efficiency measures, such as using energy-efficient appliances and installing insulation.

- Switching to renewable energy sources, such as solar, hydro or wind power.

- Encouraging sustainable transportation, such as walking, cycling, or using public transport.

- Reducing waste and increasing recycling.

- Encouraging sustainable practices among employees and stakeholders.

(4) Offset Unavoidable Carbon Emissions by Carbon Credit

Despite your best efforts, it may not be possible to completely eliminate all carbon emissions. In these cases, you can offset unavoidable emissions by investing in carbon credits. Carbon credits are a way to fund climate projects that reduce carbon emissions and promote sustainable development. By sponsoring these projects, you can offset your own carbon emissions and contribute to global efforts to combat climate change. In addition, you can register carbon-neutral labels for organizations or products such as PAS2050, PAS2060, etc from third-party verifiers.

How you can pick the right carbon credit project for your company?

(5) Apply for carbon neutral label

In order to demonstrate carbon neutrality on your product. You can apply for a carbon neutral label. This label will serve as proof that you have taken measures to offset your product carbon emissions and reduce our impact on the environment.

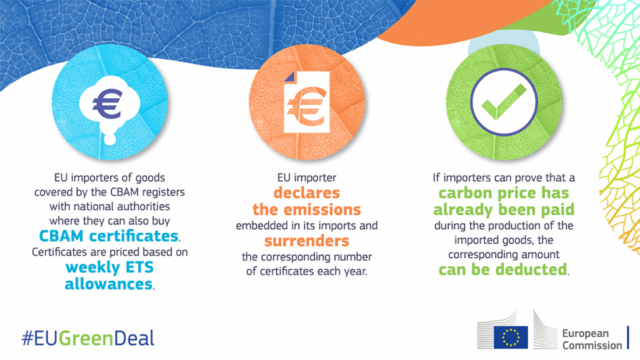

Once the permanent system enters into force on 1 January 2026, importers will need to declare each year the number of goods imported into the EU in the preceding year and their embedded GHG. They will then surrender the corresponding number of CBAM certificates.

The clock is ticking! Act now and start your journey today.

Reference:

Press Release from European Commission: https://ec.europa.eu/commission/presscorner/detail/en/qanda_21_3661

GRESB Website: https://www.gresb.com/nl-en/what-does-the-carbon-border-adjustment-mechanism-cbam-mean-for-construction/

From European Commission: https://taxation-customs.ec.europa.eu/carbon-border-adjustment-mechanism_en#:~:text=The%20CBAM%20will%20enter%20into,%2C%20fertilisers%2C%20electricity%20and%20hydrogen.